Declaration Page In Car Insurance: Understanding Its Significance

Declaration Page In Car Insurance: Understanding Its Significance – The car insurance summary page helps you get a summary of your policy, showing coverage, vehicle, coverage, price and policy duration in one place.

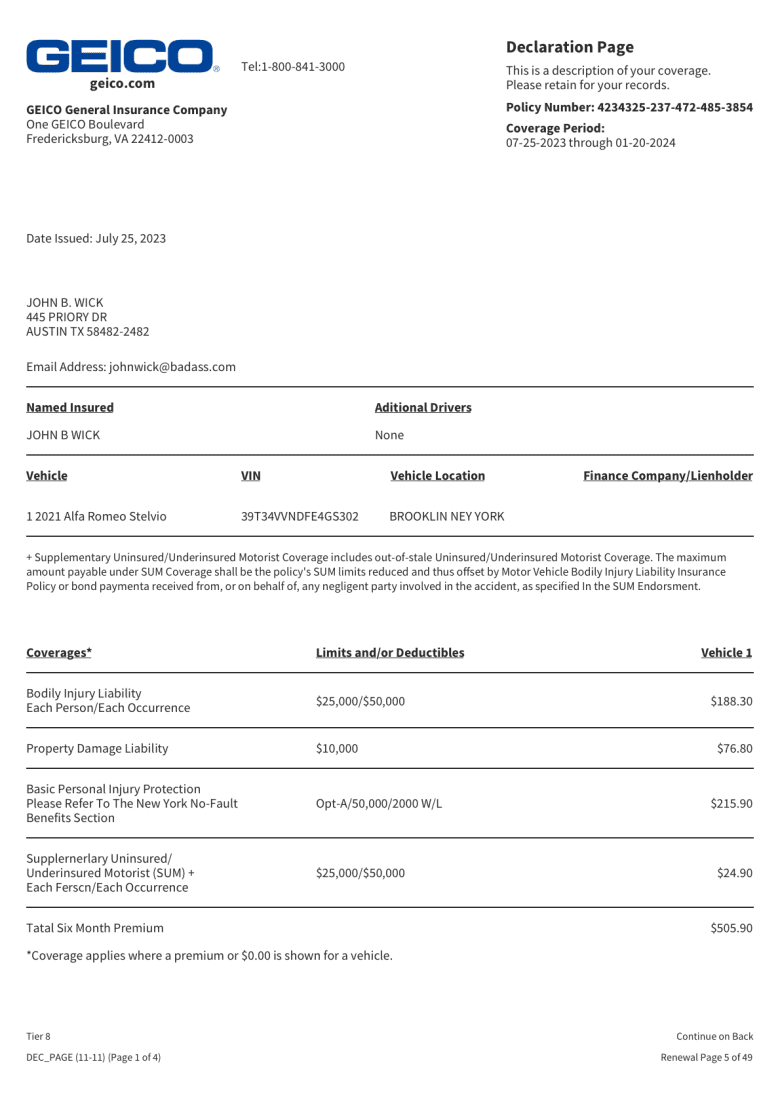

The car insurance information page provides important information such as policy name, policy number, vehicle details and coverage limits for many policy products. Serving as a summary of your insurance, its purpose is to clarify that to the insured and third parties. This important document is available online or a copy can be mailed to insurers.

Declaration Page In Car Insurance: Understanding Its Significance

:max_bytes(150000):strip_icc()/endorsement.asp-final-1e75f8d73ca64fbba3efcb79d56c0ee9.png?strip=all)

You may use the auto insurance claims page to view policy information, file a claim, update or change your policy, but should not be used as proof of insurance.

What Is An Auto Insurance Declaration Page?

While all insurance coverage pages summarize your policy, the details can vary, and “full coverage page” is different from “liability.”

Why do we believe? We carefully review content to ensure it meets the highest editorial standards. At each stage, our team writes, reviews, edits and evaluates content to ensure accuracy.

The declaration page provides an overview of your car insurance policy and is essential to understanding your coverage and is useful in the event of a claim or dispute.

If you’re wondering what an insurance policy page looks like, make sure it’s a straightforward document. Although insurance companies have different policies, they are all designed to make it easier to understand the basics of your policy. All notification sites share this type of information for everyone to see.

Understanding Your Certificate Of Insurance

Reading the car insurance policy page may seem difficult at first because of the complexity and information it contains. However, the information page is a reflection of your document, providing detailed information at a glance. Understanding how to read it will help you manage your policy and successfully handle claims.

At the top of the document, you will find the name and address of the applicant, usually you, the person who bought the insurance. If the car is owned by other people or there are other insured drivers, their names will also be shown here. Make sure your name and address are correct and legal.

Just as the Social Security number is unique to each individual, the policy number is different for each insurance policy. This number is important for all communications with the insurance company, such as making a claim, asking questions about your policy, or updating your information. Always help when you contact your insurance.

This part of the document shows when your insurance was made. It usually lasts for six months or one year, from the date the policy is established and ends when the policy expires. Keep an eye on these times to know when to renew your policy.

What You Should Know About Car Insurance After No Fault Overhaul

Here you will see information about the car or car insurance. Year, Make, Model and Vehicle Identification Number (VIN) are listed to identify insured vehicles.

This section details what your policy covers. It shows the types of insurance you have (such as liability, collision and general) and the amount of coverage for each. Understanding this amount is important to know how much protection your insurance provides.

Your premium is the cost of your insurance during the policy period. Some insurance companies can break this cost into monthly payments. Insurance costs include the make and model of your vehicle, your driving history, where you live, the coverage and deductibles you choose, and any discounts you qualify for. Insurance companies often offer discounts for driving safely, combining multiple policies or installing safety features on your car, which can lower your premium.

The deductible is the amount you pay out of pocket if you make a claim. After paying the deductible, the insurance company will apply the remainder to your insurance.

Personal Auto Policy Guide And Tips

Some policies may list certain exclusions from the policy or specify specific people who are not covered. Verifying this section is important to ensure that everyone who needs insurance is truly covered.

If you have added special coverage or important changes, it will be displayed here. This may include roadside assistance, rental income or aviation insurance.

Remember, reading and understanding the auto insurance claims page is essential to managing your insurance successfully. That way, you can make sure you get the coverage you want, the right amount, and know what to expect when you file a claim. If you find any confusing information, don’t hesitate to contact your insurance agent.

Remember that if there have been recent changes to your policy, consult the latest version on your contact page.

Geico Declaration Page

Do not discard the insurance carrier’s registration page. It contains important information about past politics. New insurance companies often ask about your insurance history and risk rating, which can affect the terms of your new policy.

You will use the Statements page to review the details of your policy. It summarizes all important aspects of your insurance such as coverage types, limits, deductibles and premiums.

When it’s time to renew your policy or compare different insurance shops, use the report page to understand your current coverage and costs.

If you have an accident or want to insure this, the report page provides important information such as your policy number and insurance information.

Ecfr :: Appendix C To Part 599, Title 49 Electronic Transaction Screen

While some agencies, such as lenders, may ask to see a contact page when you are renting or financing, it is important to remember that a contact page alone cannot be used as proof of insurance. A certificate of insurance is a recognized document that shows you are responsible for car insurance in the event of an emergency, such as a car breakdown.

If you have been involved in an accident, law enforcement or other parties may need to review your insurance, and the claims page is a summary of this.

In conclusion, the auto insurance proof page is an important document to help manage the policy, submit a claim and provide additional proof of insurance. However, remember that your insurance ID is the standard proof of valid insurance. However, it is important to visit and update your review pages.

The car insurance policy page is an important document that provides detailed information about your insurance policy. However, there are certain situations where this file is not suitable for use. Here it is:

How To Read A Car Insurance Policy

Therefore, use the information pages in the right way: especially when understanding your policy, comparing insurance options, updating your policy and making claims. Protect this file to protect your privacy

The disclaimer page is designed to be an overview of your auto policy, not an all-inclusive website. It may not specify your policy’s exclusions or other terms and conditions. For more detailed information, you will need to delve deeper into your car insurance policy or contact your provider or insurance agent.

Generally, proof pages are not proof of insurance in this case. It’s a good idea to always have your car insurance card with you or an approved digital version to show law enforcement during a traffic stop.

Proof of insurance may be required in cases where the Department of Transportation or your lender requires proof of car insurance. Although this document is similar to the disclosure page, it contains certain information that third parties may not want, such as your car insurance premiums.

Renters Insurance Declaration Page

If you choose a combination of home and car insurance, each policy still comes with its own statement page. Therefore, you will receive one statement detailing your car insurance and another detailing your home insurance.

While the auto insurance page is designed to give you a quick overview of your auto policy, there may be times when you need more information. In such cases, you can directly contact the insurance company or its representative or contact the insurance company directly.

Mark Fitzpatrick is a senior data manager with over five years of experience analyzing the insurance market, conducting original research and creating content tailored to each client. He has been quoted on the topic of coverage by several publications, including CNBC, NBC News, and Mashable.

Mark holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He uses his financial and insurance background to clarify financial issues and help others feel confident about transferring money. The car insurance policy page is the first page of your car and explains all the important details of your policy. , such as the amount of car insurance premiums and the type of coverage your policy provides. You can think of a disclosure page as a summary of your auto insurance policy.

Multirisk Management Contracts: Business

The report page (also known as the dashboard page) lists your premiums, how often you’ll pay, and the deductibles you pay for each level of coverage. It also lists your vehicle, its make, model, and vehicle identification number